You cant claim Parenting Payment before the birth of a child. If youve recently arrived as a resident in Australia you usually have to wait to get this payment.

While not as generous as the 71935 per week before tax for 18 weeks paid by the Parental Leave Scheme the Newborn Payment can work as a consolation payment for parents who dont qualify for the scheme and are dealing with the costs of a new member of the family.

How to be eligible for parenting payment. Child Care Subsidy if using. An online tool to see what payments and services you may be eligible for. Be under 66 at 66 you become eligible for a State pension.

There is no specific single parent payment or single parent pension in Australia. You can get Tax-Free Childcare at the same time as 30 hours free childcare if youre eligible. Here is a guide to the most common ones which you can access as a single mother or father of a dependent child.

This payment is income tested and assets tested. You cant submit a claim for Parenting Payment before the birth of a child. To qualify for a One-Parent Family Payment OFP you must.

We can backdate your payments. Note that in a few cases where parents are separated or divorced and share joint custody of a dependent each parent can get a 500 or 600 payment per eligible child for the first and second. Your payment reduces by 75 plus 30 cents for every dollar of income you and your partner have.

51870 or 62150 if youre separated due to illness respite care or prison. Who is eligible for the Coronavirus Supplement. Eligible Centrelink payments include Parenting Payment Single Newstart Jobseeker Payment Parenting Payment Partnered Youth Allowance Sickness.

You are not eligible for a payment if any of the following apply to you. You must submit your claim and documents within 4 weeks of your childs birth or the date the child came into your primary care. Be the parent step-parent adoptive parent or legal guardian of a relevant child this means a child under the relevant age limit - see below.

The Australian Government via Centrelink will pay a temporary fortnightly 550 Coronavirus Supplement if youre getting an eligible payment. Parenting Payment guide to claim. Rates are updated yearly on the 20th March and the 20th September.

Parenting Payment is a fortnightly payment. Parenting Payment is an income support payment for parents or guardians to help with the cost of raising children. You may be claimed as a dependent on another taxpayers return for example a child or student who may be claimed on a parents return or a dependent parent who may be claimed on an adult childs return.

However you can still access some government support as there are a few payments you may be eligible for. Weve temporarily removed this newly arrived residents waiting period for Parenting Payment. We will guide you through the claim process.

To be eligible for Parenting Payment you must. Heres an example of how Australian Government parenting payments work.

Single and care for a child under 8 or. Meet an income and assets test. How to claim Complete the following steps to claim Parenting Payment.

You may also need to do both of these. Have a partner and care for a child under 6. Example of parenting payments.

The Single Parent Pension is known as the Parenting Payment. What your commitments are There are some things you must do to keep getting your Parenting Payment. How to manage your payment.

If your adjusted gross income or AGI is 100000 or over you wont be eligible for a third payment of any amount. These parents may be eligible for PPS until their youngest child turns 8 eligibility depends on income and other circumstances. Parenting Payment This payment is for low-income parents and carers.

You may need to take part in ParentsNext. However if you make between 75000 and 100000 you could get a portion of. If your youngest child is younger than 6.

A single parent with no income no assets and dependent children might be eligible for. Parenting Payment Single PPS is an income support payment available to single parents and other principal carers who have sole or primary responsibility for the care of a young child. Choose a language In your language.

A parent with 5050 custody of one or more children who didnt receive a 500 payment per child as part of the stimulus package can get that money along with their tax refund after filing 2020. This is due to coronavirus COVID-19. For every 8 you pay into this account the government will pay in 2 to use to pay your provider.

Do the activities youve agreed to do. Agree to a participation plan. Between 212 and 512.

Your payment reduces by 25 cents for every dollar of income you and your partner have over 212. This payment is impacted by a number of factors where you live who you live with how much you earn your other Centrelink payments and whether or not you receive any child support from the other parent of your child. Youll get your first payment 2 weeks after we approve your claim.

You must continue to meet the residence rules to keep getting this payment. What would you like to look for first.

What Does Hr Need To Know About Uk Maternity Leave Personio

What Does Hr Need To Know About Uk Maternity Leave Personio

Paid Parental Leave Australia Myob Essentials Accounting Myob Help Centre

Paid Parental Leave Australia Myob Essentials Accounting Myob Help Centre

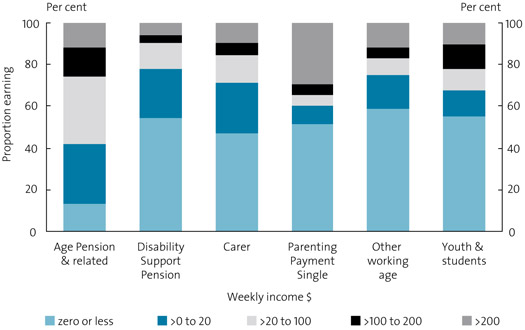

Pension Review Background Paper Department Of Social Services Australian Government

Pension Review Background Paper Department Of Social Services Australian Government

Government Parenting Payments Raising Children Network

Government Parenting Payments Raising Children Network

Getting Help During Coronavirus Covid 19 I M A Parent Services Australia

Carer Payment Child A New Approach Report Of The Carer Payment Child Review Taskforce Department Of Social Services Australian Government

Carer Payment Child A New Approach Report Of The Carer Payment Child Review Taskforce Department Of Social Services Australian Government

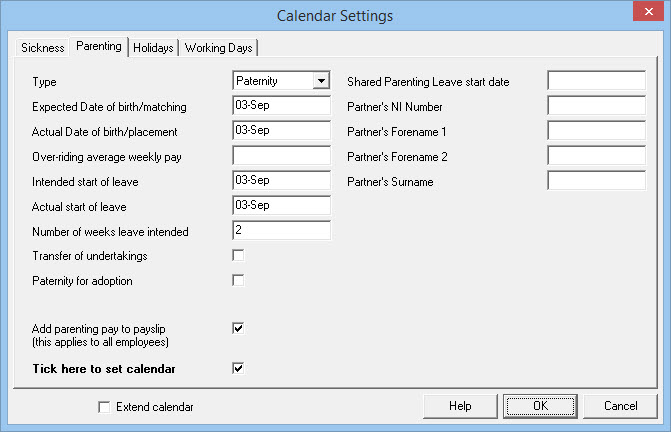

Statutory Paternity Pay Spp Moneysoft

Statutory Paternity Pay Spp Moneysoft

Centrelink Advance Payment 1000 Explained 7news Com Au

Centrelink Advance Payment 1000 Explained 7news Com Au

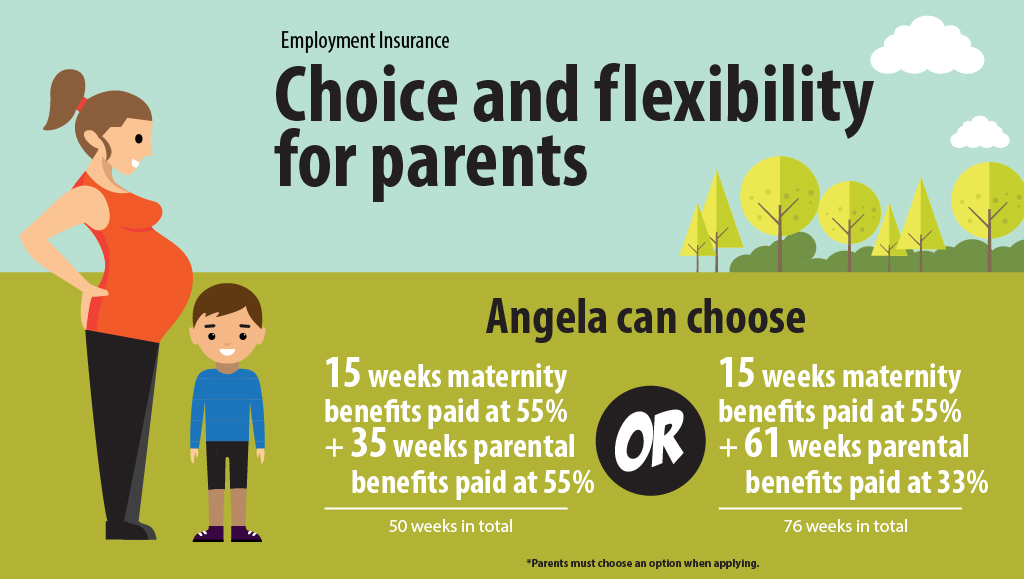

More Choice For Parents Canada Ca

More Choice For Parents Canada Ca

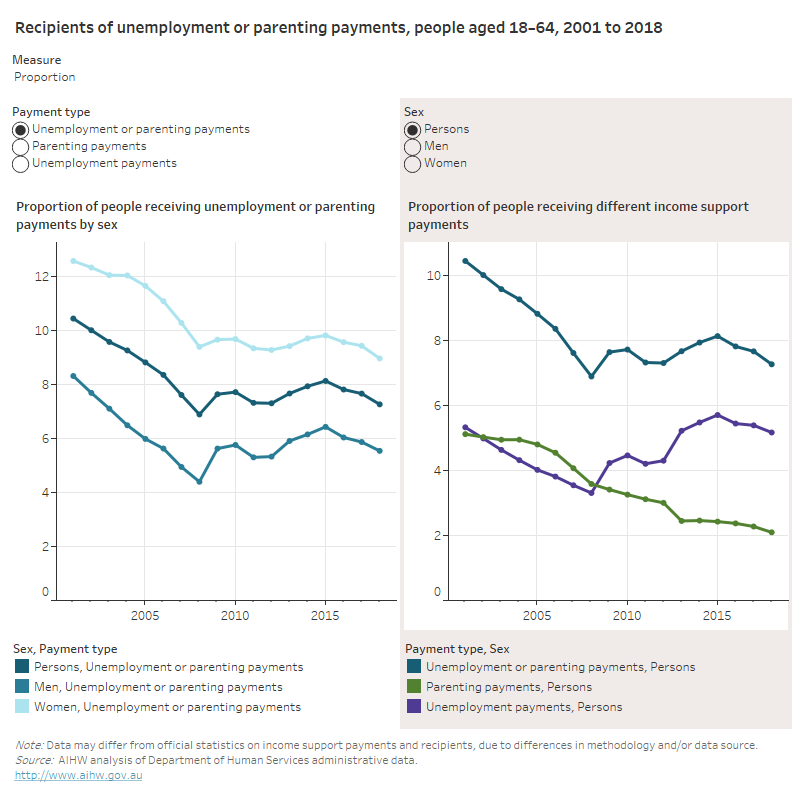

Unemployment And Parenting Income Support Payments Australian Institute Of Health And Welfare

Unemployment And Parenting Income Support Payments Australian Institute Of Health And Welfare

0 comments:

Post a Comment